NOW YOU KNOW…

We hope you find our Blog Articles both Helpful and Informative. Our Blog contains various Categories and Topics.

The Top 10 Hypoglycemia Neglect Myths in Nursing Homes

Hypoglycemia, or low blood sugar, is a common health issue among elderly residents in nursing homes. Unfortunately, hypoglycemia neglect is also a serious issue in nursing homes, and it can lead to serious harm and injuries. There are many myths and misconceptions surrounding hypoglycemia neglect in nursing homes, which can make it difficult for...

5 FAQs for Parents Seeking to File a NICA Claim in Florida

When facing a birth-related neurological injury, the stress and emotional toll on a family can be immense. The Florida Birth-Related Neurological Injury Compensation Act (NICA) aims to ease some of that burden by offering a streamlined avenue for compensation. Despite its advantages, navigating...

Understanding Birth Injury Cerebral Palsy: Causes, Symptoms, and Treatment

Cerebral palsy is a set of neurological disorders that impact muscle control and movement. It can cause difficulty with posture and coordination too. Cerebral palsy occurs when there is damage to the developing brain, either during or near the time of birth. Understanding the link between birth injury and cerebral palsy can shed light...

The Most Common Hypoglycemia Neglect Injuries in Nursing Homes

Hypoglycemia, or low blood sugar, is a common issue among elderly residents in nursing homes. It can be caused by a variety of factors, including medication side effects, poor diet, and inadequate monitoring. When nursing homes neglect their duties to properly monitor and manage...

Post-Fall Medical Evaluations and Their Importance in Nursing Home Falls

Let's get real: if you have a loved one in a nursing home, one of your biggest fears is likely them falling. But what happens after a fall occurs? I can't emphasize enough the critical role that post-fall medical evaluations play in this scenario. They aren't just a medical nicety; they're a non-negotiable aspect...

Best Practices to Mitigate Risk Factors for Elopements in Nursing Homes

The issue of elopement in nursing homes has surged into the spotlight in recent years, creating a challenge for healthcare providers and administrators alike. Defined as the unauthorized or unsupervised departure of a resident from a facility, elopement presents significant safety...

Addressing Constipation in Elderly Residents: Typical Nursing Home Interventions

Constipation, while often overlooked, is a pervasive issue in nursing homes, particularly among the elderly population. The lack of physical mobility, coupled with specific medications and insufficient dietary fiber, exacerbates the problem. Managing constipation effectively is crucial, not just for...

The Impact of Federal Regulations on Skin Care and Pressure Sores in the Context of Nursing Home Neglect and Pressure Sore Development

When it comes to the quality of nursing home care, the federal regulations are your best friend. Trust me, they're the rulebook that ensures your loved ones are not just housed, but actually cared for. CMS sets the gold standard for nursing home care through a set of regulations often referred to as...

Comparing NICA and Medical Malpractice Suits in Florida: What Parents Need to Know

When faced with a birth-related neurological injury, parents in Florida are often overwhelmed, not only emotionally but also when it comes to understanding their legal options. Two avenues of recourse are available: The Florida Birth-Related Neurological Injury Compensation Act (NICA) and medical malpractice lawsuits. Both come with their own...

Understanding Birth Injury and Its Causes

Birth injuries can be a devastating and unexpected experience for families, often leading to lifelong consequences for both the child and the parents. But what exactly are birth injuries, and what causes them? We will discuss the role of medical malpractice in causing preventable birth injuries and the legal options for affected families...

The Role of Medical Experts in Hypoglycemia Neglect Cases

Hypoglycemia, commonly known as low blood sugar, is a severe condition that occurs when the body's blood sugar drops below normal levels. The symptoms of hypoglycemia can be mild to severe, depending on how low the blood sugar level drops. In extreme cases, hypoglycemia can lead to seizures, coma, and even death. Neglecting hypoglycemia...

Federal and Florida Regulatory Guidelines on Orthopedic Aids in Nursing Homes

Orthopedic aids in nursing homes? Whether it's a basic walker or a state-of-the-art wheelchair, these aids play an integral role in the lives of many nursing home residents. And, you guessed it, they're subject to a labyrinth of federal and state...

Interdisciplinary Training Programs for Elopement and Injury Prevention in Nursing Homes

Elopement and injury prevention in nursing homes is not the sole responsibility of nurses or security staff—it is a collective effort that requires the expertise of multiple disciplines. The crux of effective prevention lies in interdisciplinary training programs that incorporate insights and expertise from various fields such as nursing...

The Importance of Repositioning for Pressure Sore Prevention in Nursing Homes

Imagine having a pebble in your shoe. Not very comfortable, is it? Now, imagine not being able to remove that pebble for an extended period of time. That's kind of what pressure sores are like for many elderly individuals in nursing homes—just far more serious and, unfortunately, often far more painful. And just like...

Alternatives to Sliding Scale Insulin Therapy in Nursing Homes

Diabetes is a common chronic condition among elderly residents in nursing homes. Sliding scale insulin therapy has been a widely used approach for managing blood sugar levels in these individuals. However, this approach has several limitations and may not always be the best option for optimal blood sugar control and reducing the risk of...

The Benefits and Challenges of Interdisciplinary Teams in Developing Individualized Care Plans for Diabetes Management in Nursing Homes

Managing diabetes in nursing homes requires a collaborative and multidisciplinary approach. Interdisciplinary teams, or IDTs, which include healthcare professionals from different disciplines, can provide comprehensive care that considers the unique needs of residents with diabetes. IDT teams are different from care plan conferences. While care plan...

Understanding NICA Eligibility in Florida: A Comprehensive Guide

Navigating the intricacies of birth injury laws can be a daunting experience for parents whose child has sustained birth-related neurological injuries. The Florida Birth-Related Neurological Injury Compensation Association (NICA) serves as a much-needed respite, offering compensation without the need for litigation. However, it’s essential to understand the...

Understanding the Risks of Birth Complications in 2024

With the rapid advancements in medical technology, one might think that birth complications are a thing of the past. But the truth is, they still occur, and it’s essential to understand the risks and warning signs to ensure a safe and healthy delivery...

Low Beds vs. Traditional Beds for Fall Safety in Nursing Homes

At first glance, you might think, "What's the big deal? A bed's a bed, right?" But when you dig into the choice between low and traditional beds becomes a nuanced discussion with implications for resident safety, quality of life, and even legal considerations. Let's start with the old-school, shall we? Traditional beds have been...

FAQs on Elopements and Injuries in Florida Assisted Living Facilities: A Legal Overview

Elopements and injuries within assisted living facilities are not only a healthcare concern but also a legal one. This is particularly true in Florida, where a growing population of older adults resides in assisted living environments. This article addresses some of the most frequently asked questions on the subject, taking into account the specifics...

FAQs on Pursuing Legal Action for Bowel Obstruction Due to Hydration Negligence in Nursing Homes

Bowel obstruction in nursing home residents is a medical emergency that often requires prompt attention. Yet, what if the underlying cause was not a mere accident but rather the result of inadequate hydration protocols? In such cases, the legal landscape offers options for families seeking justice. Below are some frequently asked questions that...

The Relationship Between Mobility and Pressure Sores

How does something simple as moving around affect the development of pressure sores. But what happens when mobility is restricted? Among other issues, the risk of pressure sores—those nasty, painful skin lesions—rises...

The Vital Role of Personalized Care Plans in Florida Nursing Homes for Maintaining Optimal Blood Sugar Levels

As we age, our bodies undergo a multitude of changes that can impact our health in various ways. One common health concern among elderly individuals is managing blood sugar levels. In Florida nursing homes, managing blood sugar levels is crucial to preventing complications associated with...

The Connection Between Staffing Levels and Effective Diabetes Management in Nursing Homes

Diabetes is a chronic disease that requires consistent and individualized management to prevent serious complications. Nursing homes are responsible for providing care to a large population of elderly individuals with diabetes, which can be challenging without adequate...

How Nursing Homes Should Follow Patient-Centered Approaches in Fall Risk Assessment

Patient-centered care isn't just another buzzword. It's a shift in focus, a pivot from traditional medical practices that put the system before the individual. In essence, it means looking at residents as unique individuals with distinct needs, preferences, and histories. It is something every nursing home should...

Understanding Klumpke Palsy – Symptoms, Causes, Treatment and Prognosis

Klumpke Palsy, a lesser-known but impactful condition, can dramatically affect the lives of those who experience it. In this blog post, we delve into the depths of Klumpke Palsy, exploring its causes, symptoms, and treatments, as well as offering insights into prevention and legal...

What Role Do Florida State Surveyors Play in Identifying Nursing Homes with High Rates of Resident Falls?

We're about to plunge into the vital role that Florida state surveyors play in ensuring the well-being of nursing home residents. When it comes to keeping tabs on resident falls in nursing homes, these surveyors are akin to guardians of a sacred trust. You bet they have a lot on their...

Common Complications in Pregnancy: Causes, Symptoms and Treatments

Pregnancy, a miraculous journey, brings joy and anticipation to expectant parents. However, even the healthiest pregnancy can be accompanied by complications in pregnancy that require close monitoring and management to ensure the well-being of both mother and baby. In the ever-changing landscape of pregnancy, understanding these potential...

What Do F-Tags and Falls Mean in Nursing Homes?

So, you've heard the term "F-Tags" thrown around and you're scratching your head, right? Let's put it into plain English: When we're talking about F-Tags, we're diving deep into the regulatory framework that keeps nursing homes in check. And when it comes to "falls," we're not discussing autumn leaves. Instead, we’re spotlighting one of...

Understanding Birth Asphyxia: Causes, Treatment, and Outlook

Imagine the joy of welcoming a new life into the world, only to have that happiness clouded by a devastating medical condition. Birth asphyxia is a reality that many families face, and understanding its causes, symptoms, and long-term effects is crucial for early detection and intervention. This blog post aims to shed light on...

A Step-By-Step Guide to Filing Florida NICA Claims: What Parents Need to Know

Navigating the complex world of medical care and compensation following a birth-related neurological injury can be overwhelming. That’s why the Florida Birth-Related Neurological Injury Compensation Act (NICA) exists—to provide a streamlined process for families to seek...

Unlocking the Benefits of NICA Florida – Birth-Related Neurological Injury Compensation Plan Explained

Imagine a lifeline that offers financial assistance and essential support services to families of children born with birth-related neurological injuries. The NICA Florida program does just that! In this blog post, we will explore the ins and outs of NICA Florida, diving deep into its benefits, eligibility requirements, and its positive impact on Florida’s...

The Emotional Toll of Hypoglycemia Neglect in Nursing Homes: Grief and Support Services in Orlando, Florida

Hypoglycemia, or low blood sugar, is a common health issue among elderly residents in nursing homes. However, when nursing homes neglect their duties to properly monitor and manage residents' blood sugar levels, the consequences can be devastating. Not only can hypoglycemia lead to physical harm and medical complications, but it can also have a...

Root Cause Analysis Following Fall Incidents at Nursing Homes in Florida

"Someone fell again," you might overhear staff say at a nursing home in Florida. But if you dig a little deeper, you'll find that every fall has a backstory—a complex mix of circumstances, decisions, and, well, gravity. The crux of it all? Root cause analysis. This is where the rubber meets the road in...

Staffing Levels and Elopement Risk in Elderly Care: An In-Depth Look at Nursing Homes

When entrusting the care of an elderly family member to a nursing home, the number one concern is often safety. One safety issue that doesn't get the attention it deserves, yet has potentially serious consequences, is the risk of elopement—defined as an unauthorized or unsupervised departure from the facility by a resident. While multiple...

Individualized Facility Care Plans & Prevention Strategies for Bowel Obstruction in Nursing Homes

In the realm of nursing home care, bowel obstruction is an acute medical condition that demands prompt attention. However, the adage "prevention is better than cure" couldn't be more applicable. The effective prevention of bowel obstructions hinges on individualized facility care plans...

The Role of Communication in Preventing Nursing Home Neglect and Pressure Sore Development

Let's get one thing straight: Communication isn't just the glue that holds personal relationships together; it's the very foundation of quality healthcare, especially in nursing homes. A break in this essential element can turn what should be a sanctuary for elder care into a breeding ground for...

How do I document the accident scene and gather evidence if I am injured in a Slip and Fall accident at a business in Florida?

If you are injured in a slip and fall accident at a business in Florida, you may be entitled to compensation for your medical expenses, lost wages, pain and suffering, and other damages. However, to prove your claim, you will need to document the accident scene and gather evidence of the business's negligence. Here...

What Type of Doctors Should I Visit Following a Car Accident in FL?

Car accidents can cause serious injuries that require medical attention. If you have been involved in a car accident in Florida, you may be wondering what type of doctors you should visit following the incident. Here are some tips to help you find the right medical professionals for your [...]

Life-Threatening Complications During Pregnancy: Risk Factors and Trends

Pregnancy is a miraculous journey, but it can also bring about risks and “life threatening complications during pregnancy” that can be life-threatening for both mother and baby. Understanding these complications, their risk factors, and how to prevent or manage them is crucial to ensure the safety and [...]

The Impact of Nursing Home Medication Errors on Blood Sugar Levels

Medication errors are a significant problem in nursing homes. These errors can lead to severe consequences, such as hospitalization, disability, and even death. One of the critical areas where medication errors can occur is in the management of diabetes in nursing home residents. Diabetes is a common chronic condition among older adults, and it...

Case Studies Unveiled: What They Say About Staffing Levels and Fall Prevention in Nursing Homes

You know, folks, we often hear about the importance of adequate staffing in nursing homes, especially when it comes to fall prevention. But let's be real—how often do we actually dive into the data to confirm these claims? We're about to dig into some compelling case studies that shed light on the relationship between...

Data and Statistics on Nursing Home Elopements and Injuries: An Analytical Overview

The prevalence of elopements and injuries in nursing homes remains a topic of significant concern among healthcare professionals, regulatory bodies, and families of residents. Although these incidents are often reported, there is a conspicuous absence of a centralized discussion that delves into the statistics behind these occurrences [...]

Clinical Protocols for Immediate Nursing Home Intervention in Suspected Cases of Bowel Obstruction

Bowel obstructions are medical emergencies that can present unique challenges within a nursing home setting. Given the vulnerability of this population and the complexities associated with co-morbid conditions, immediate and precise interventions are required. [...]

How Poor Hygiene in Nursing Homes Can Lead to Pressure Sores

You know, we often associate nursing homes with the comfort and specialized care they're supposed to provide. However, not all facilities are created equal, and there's an unsettling side to this story—poor hygiene practices. You might not think it at first, but poor hygiene is [...]

What Do I Need to Prove My Car Accident Claim in Florida?

If your car accident was the result of the other party’s negligence, you are probably interested in proving your claim to recover damages. Under Florida law, when bringing a personal injury claim against another driver, you need to prove four elements [...]

Legal Considerations: Medical Negligence and Birth Injury Cerebral Palsy

Medical negligence is defined as a failure to provide the expected standard of care to a patient, which in this case could have resulted in harm to the child before and during childbirth. If a child is suspected of having cerebral palsy due to medical negligence, seeking [...]

Nursing Home Federal Regulations and Hypoglycemia Prevention

As the population continues to age, the demand for nursing homes and long-term care facilities has increased. One of the critical aspects of care in these facilities is the prevention and management of hypoglycemia in older adults. The federal government has implemented Federal regulations to ensure that nursing homes provide adequate care and [...]

Unpacking the Connection: Shift Length for Nurses and Fall Frequency in Nursing Homes

Ah, the classic 12-hour nursing shift—But have you ever stopped to think what impact these lengthy shifts have on patient safety? Specifically, how do they influence the frequency of falls in nursing homes [...]

Staff Training Compliance and Its Impact on Elopement Rates in Nursing Homes

Elopement—unauthorized and unsupervised departures from nursing homes—poses severe risks to residents. While multiple factors contribute to elopement incidents, one often overlooked aspect is the quality of staff training. A robust training program isn't just an administrative necessity; it’s a frontline defense against the risks associated with [...]

Comprehensive Insights into the Causes of Bowel Obstruction in Elderly Nursing Home Residents

The complexities of bowel obstruction in the elderly population, specifically those residing in nursing homes, demand an in-depth understanding of the multiple causative [...]

The Impact of Staffing Levels on Nursing Home Neglect and Pressure Sore Development

Everyone knows it's unrealistic to expect a handful of nursing staff to provide optimal care for a large number of residents in a nursing home. The correlation between staffing levels and nursing home neglect, particularly in the context of pressure sore development, is stark and significant. So, let's break down the various ways inadequate...

Recognizing Hypoglycemia in Elderly Residents: What Nursing Home Staff Can Do

To timely recognize hypoglycemia in elderly residents, nursing home staff should be aware of the signs and symptoms associated with this condition. They should also be trained in proper glucose monitoring techniques, as well as how to properly administer insulin and the correct use of [...]

Preventable vs. Unpreventable Elopements: Criteria in Nursing Homes

Elopements in nursing homes present a significant challenge for caregivers, administrators, and families alike. As such incidents can lead to injuries, legal ramifications, and tarnished reputations for healthcare providers, the importance of understanding the nuances of elopement cannot be [...]

How Florida State Regulations Shape Staffing Levels for Fall Prevention in Nursing Homes

Choosing a nursing home for a loved one is one heck of an emotional rollercoaster, am I right? Amidst a sea of glossy brochures and polished websites, the real questions often go unanswered. However, staffing levels—especially in the context of fall prevention—should be your top concern. Here in the Sunshine State, we're fortunate to...

The Vital Role of Routine Bowel Check-ups in Nursing Homes for Identifying Bowel Obstruction

Bowel obstruction is a potentially life-threatening condition that requires immediate attention, and unfortunately, it occurs more frequently among the elderly—a demographic that constitutes the majority of nursing home residents. This makes the role of routine bowel check-ups in nursing homes pivotal for timely identification and subsequent [...]

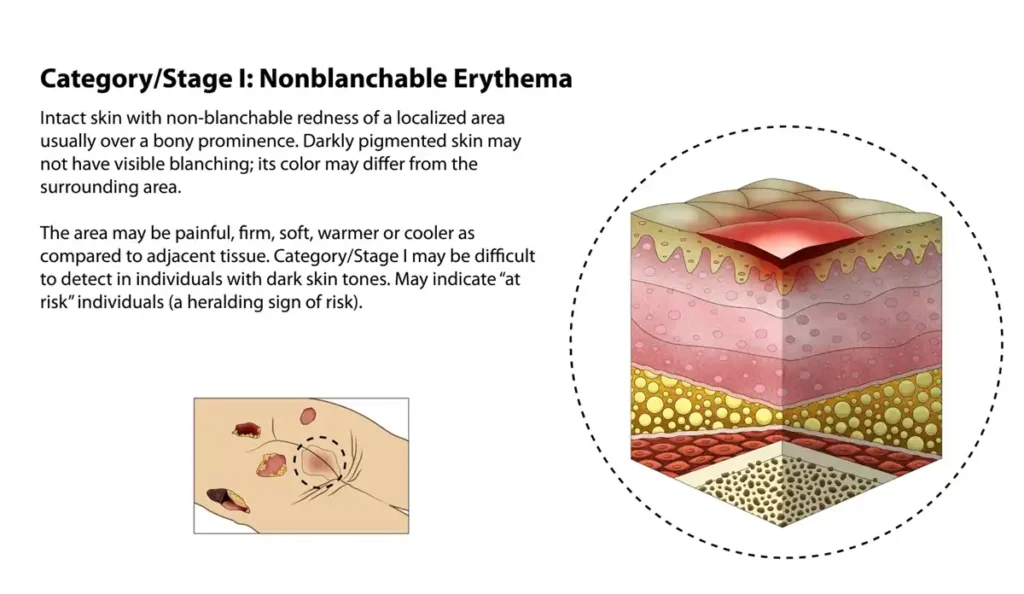

The Complete Guide to Pressure Sores: What Are They and How Are They Caused?

Pressure sores, also known as bedsores or pressure ulcers, are skin injuries that result from prolonged pressure on a particular area of the body. According to the CDC, about 11% of nursing home residents have pressure sores. They commonly occur in regions where the skin covers bony areas, such as heels, hips, and tailbones....

Navigating the Complex World of NICA: Your Guide to Compensation for Birth-Related Neurological Injuries

At Turnbull Law Firm, we recognize how critical it is to protect the rights and well-being of families and children affected by birth-related neurological injuries. This comprehensive guide explores the ins and outs of the Florida Birth Related Neurological Injury Compensation Act (NICA). Florida Birth Related Neurological Injury Compensation Act is designed to help...

When Can You Sue a Business for a Slip and Fall Accident in a Public Restroom in the State of Florida?

Slip and fall accidents can happen anywhere, including public restrooms within businesses in the State of Florida. If you've suffered injuries due to a slip and fall incident in a public restroom, you may wonder whether you have grounds to sue the business for your injuries. In this blog, we'll explore the circumstances under...

Civil Liability for Wrongful Death in Florida: A Separate Path from Criminal Acquittal

In the legal realm, wrongful death cases often raise complex questions about culpability and justice. One such question is whether a person can be found liable for wrongful death in a civil case in the State of Florida, even if they were found not guilty in a criminal case related to the same incident....

Out-of-State Trucking Companies and Car Driver Injury Claims in Florida: Navigating the Legal Complexities

A car driver's life can take a devastating turn when involved in a trucking accident in the Sunshine State. When the trucking company is based in another state, it introduces a layer of complexity into the personal injury claim process in Florida. In this blog, we'll explore the intricacies of how the involvement of...

Catastrophic Injuries in Florida: Legal Claims, Liability, Compensation, and Wrongful Death

Accidents can occur at any time, often resulting in injuries that range from minor bruises to severe, life-altering conditions. In the state of Florida, as in many other places, there is a legal framework in place to address injuries caused by someone else's negligence or misconduct. Catastrophic injuries, in particular, represent a significant category...

Liability for Motorcycle Accidents in Florida: Grass Clippings on the Road

Motorcycle enthusiasts often relish the freedom and exhilaration that comes with riding on the open road. However, this joy can quickly turn into tragedy when accidents occur. In Florida, as in many other states, determining liability for motorcycle accidents can be complex, and it may extend to unexpected scenarios such as grass clippings on...

The Impact of Smartphone Use on Car Accidents in Florida and its Role in Legal Claims

In today's fast-paced world, smartphones have become an integral part of our lives. However, their misuse, particularly while driving, has led to a significant increase in car accidents across the State of Florida. In this blog, we'll delve into the alarming rise of accidents related to smartphone use, the utilization of smartphone data as...

Navigating Florida Workers’ Compensation and Personal Injury Claims in Warehouse Injuries

Warehouse injuries can be life-altering, and understanding how Florida's workers' compensation system may intersect with a personal injury claim against the warehouse is crucial. In this blog, we'll explore how issues related to Florida's workers' compensation may affect a personal injury claim against the warehouse and how an experienced Florida personal injury attorney can...

Plant Accidents in Florida: Understanding Your Rights Despite Signed Waivers

Plant accidents in the State of Florida can result in severe injuries, and individuals injured in such incidents may wonder about their legal rights, especially when they signed a waiver or release before the accident as a condition of employment. In this blog, we'll explore an individual's legal rights to file a personal injury...

Hypertension in Pregnancy: The Disparate Treatment of Black Women

One of the most alarming disparities in maternal healthcare is the treatment of hypertension among pregnant women, a condition that threatens both maternal and fetal health. When we dissect the racial undertones of this issue, the evidence is startling. Black pregnant women face higher risks of hypertensive disorders and often receive different—and sometimes [...]

What Constitutes Elopement in Nursing Homes: An In-Depth Look at Florida Law and Federal Statutes

Elopement in nursing homes is a critical issue that has far-reaching implications, from the safety of residents to the legal ramifications for healthcare facilities. While the term "elopement" may conjure up romantic notions of running away for a clandestine union, in the context of nursing homes, it refers to a dangerous and potentially life-threatening...

4 THINGS YOU MUST DO WHEN FOG CONTRIBUTES TO YOUR CAR ACCIDENT

I’m going to liberally steal a phrase from one of my favorite artists, the Late Notorious BIG, when you are in Florida the Mo Fog, the Mo Problems, the Mo Accidents. I was driving from Tampa to our Lakeland office to prepare for depositions in Winter Haven when I hit some serious fog on...

What to Do if You Were Injured Due to a Defective Firework in Florida?

Every Fourth of July, fireworks light up the sky across the entire country. While fireworks are incredibly fascinating to watch, they can also cause serious injuries and deaths. While a large percentage of firework injuries occur as a result of improper use, many are caused by defective fireworks. Unfortunately, many fireworks sold [...]

Are Utilities Immune from Liability in Power Plant Accidents in FL?

When people suffer injuries in a plant accident, many of them are worried that they will not be fully compensated for their injuries because the utility is immune from liability. But can a utility be shielded from liability for injuries stemming from plant accidents? Most recently, following a power plant accident in Hillsborough County,...

Who’s Liable for Injuries in a FL Car-Motorcycle Accident?

Florida has the highest number of motorcyclist fatalities in the country. While motorcycle crashes are not as common as regular auto accidents involving passenger vehicles, they tend to be more catastrophic and deadlier. In fact, motorcyclists are more susceptible to injuries in car-motorcycle accidents compared to car drivers and passengers. This was evident in...

How to Prove Constructive Knowledge of a Hazard in Florida Slip and Fall Lawsuits?

Under Florida law, property owners and occupiers are legally required to maintain their premises free of hazards. If the owner cannot ensure that their property is safe for visitors and guests, they can be held liable for any resulting injuries and losses. Visitors and guests who sustain injuries in slip and fall accidents on...

When is the truck driver not to blame for a big-rig wreck?

There are countless kinds of mistakes and combinations of circumstances that might lead to a collision between a semitruck and a smaller passenger vehicle. Either driver can make a mistake. Issues with the weather or the roads can lead to people losing control of their vehicles. The risks are virtually endless and [...]

Exploring Personal Injury Claims for Warehouse Injuries in Florida: When Workers’ Compensation Isn’t Enough

Working in a warehouse can be physically demanding and at times hazardous. While workers' compensation is often the safety net for employees injured on the job, there are instances when a warehouse injury in the State of Florida might warrant a personal injury legal claim. This article delves into the circumstances under which such...

Seeking Justice in Florida: Understanding Wrongful Death Laws and the Importance of Legal Representation

Losing a loved one due to someone else's negligence or intentional actions is an incredibly traumatic experience. In the state of Florida, wrongful death laws have been established to provide a legal avenue for families to seek compensation and damages for the loss of their loved ones in cases of personal injury. These laws...